Shift4 Q3 2024 Earnings Review

Shift4 Q3 2024 Earnings Results

Shift4 reported mixed results this past week. E2E volumes grew +56% YoY, while Gross Revenues Less Network Fees were up 48%. Gross margins fell about 100 bps YoY to 69.4%. Net spreads continued to fall modestly, to 60 bps down 5 bps YoY while offsets from a larger average merchant size allowed them to grow at a rapid clip. Like much of the company’s corporate history, cost management was strong with EBITDA margins at 54%, excluding the impact from recent M&A which added a 250 bps drag on headline figures. FCF conversion (Adjusted FCF/Adj EBITDA) was 58% in-line with expectations. All said, outside of payment volumes being a bit soft nothing too notable to call out from the reported results.

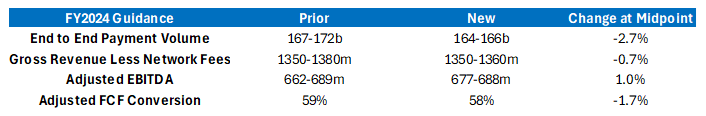

Due to this environment, the company cut E2E and Gross Revenue Less Network Fees for FY2024. EBITDA guidance was increased incorporating the GiveX acquisition. Exhibit A1 outlines the FY guidance changes. Cyclical headwinds from “higher interest rates, higher inflation and overall consumer fatigue from spending significantly more eating out and staying at hotels” were the key drivers to the de-minimis guidance reduction. Despite these headwinds, FOUR grew its contracted backlog from backlog grew from 25b last quarter to 33b, with a gross 13b added in the quarter.

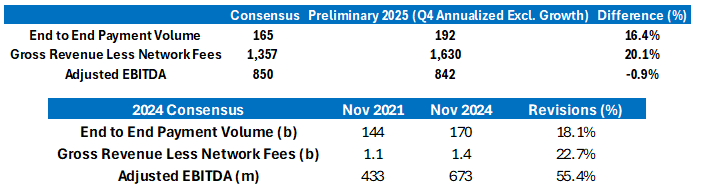

With all eyes on 2025, management hinted at what guidance could look like based on annualizing the figures from Q4/2024 excluding any impacts from other growth or seasonal factors. This puts 2025 at 192b in E2E volume, 1.6b in Gross Revenues Less Network Fees and 842m in Adjusted EBITDA. About 16% higher on E2E than consensus expectations and 20% higher on Gross Revenues as shown in Exhibit A2 While EBITDA is in-line with consensus, it still implies >25% growth relative to 2024. Pretty Pretty Good. And, while I’m not 100% certain they’ll beat these hurdles next year looking back at the prior 3-year record shows very good execution and expectations management. In my mind, the management say vs execute ratio is quite good.

Hospitality Vertical

Like many other quarters, Shift4 called out a number of new customers in this vertical. This quarter it includes KSL Properties and a large Las Vegas Casino Operator (Fontainebleau?) with multiple casino locations internationally. The consistent wins are nice to see but it’s hard to always square how meaningful any individual addition is at this point. An important point to remember is that when Shift4 wins a customer at a hotel or resort they are powering all the payments including the gift shops, spas and restaurants. Like other vertical’s there is still a healthy runway to convert gateway customers and expand into Canadian and European markets. It remains difficult to see how a new entrant would be able to easily replicate the 500+ integrations that are needed to successfully compete in this area.

Restaurant Vertical

With over 55,000 Skytab installations since the beta release – Shift4 is tracking well ahead of their prior 30,000 target for installs in 2024. They are on track to complete >35,000 installations this year and management believes they have continued to take market share. Restaurants continue to have the best blended spreads of all the verticals given the customer size and relative negotiating power – I see little reason this will change materially over time. Heck there’s even some chance it goes up on a corporate basis as they expand into Europe and Internationally.

But I do have to call out how their previous target of ~10,000 international customers by YE24 isn’t going to be met. They are tracking closer to ~1,000 customers today. It seems like they ran into a few regional issues which have slowed progress. However, the company isn’t using any different playbook compared to other POS acquisitions and I’m very confident that more of the ~65,000 Vectron/Revel systems will eventually be converted to the full E2E solution over time. The playbook to convert the legacy POS customers is to waive the gateway fees, hardware costs, software costs, refresh the devices and at times offer a signing bonus to convert.

In Europe, the software plus payments opportunity has far from converged and most operators in this region aren’t offering a bundled solution like the US. I’ve yet to hear of a compelling reason as to why the European market won’t look like the US with enough time. Shift4 generated only 4% of revenues internationally in 2023, and a very large number of F&B companies are soon going to be enabled with the full capabilities that merchants have in the USA. With ~300 POS resellers and some internal sales capabilities in the region. I think the cross-sell and conversion opportunity will be captured its just a matter of when. A single throat to choke will still have its benefits in Europe.

I think number one, which shouldn't be too surprising, but it even is to us in some respects, which is just complex card-present capabilities. So if you think about the giants of Europe that, and those that have done an absolutely outstanding job, Adyen started as a Card Not Present player. You're talking more basic single software type integrations for card-present because it's a relatively new world for them. Stripe, incredible e-commerce capabilities, very basic card-present capabilities. I mean, Shop Pay, Simple Terminal.

This is why, like, from my perspective, when I ask, like, why are we even involved in all these transit systems or why are we getting, why are we winding up in all these EV operators across Europe? It's because there isn't, there isn't, there isn't like that super tech player in Europe that focused on card-present capabilities. So it's traditional old stuff. It's Barclay Cards is huge, say, in the UK worldline does a lot of volume. It is not an integrated payments player.

So I think that is, like, turning out to have some surprising benefits for us in Europe. But I mean, our main focus of going over there with card-present was our restaurant product, our hotel integrations, our stadium product. But we are clearly doing well in kind of complex integrated payments from a card-present perspective.

Sports & Entertainment Vertical

S&E trends remained strong in the quarter – this quarter included the Memphis Grizzlies, San Antonio Spurs, and the Dallas stars to name a few. One notable trend I expected in my initial report was a higher rate of ticketing included in these new wins which continues to progress very nicely. Not only are the trends remaining strong, what is under appreciated is the 4-5x uplift in payment volume they will capture if they win the Ticketing opportunity. It increasingly seems to be their partnership with Seatgeek is allowing them to win in more often. With ~66% share in major league venues they look well positioned from a scale and relationship perspective.

Giving Block and Crypto Vertical

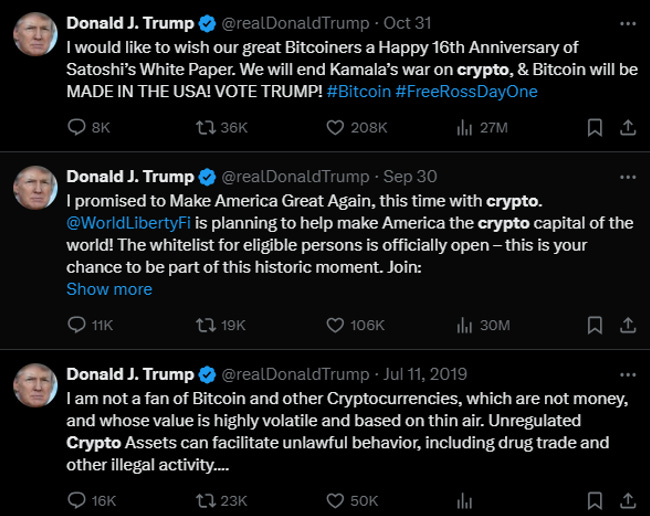

As many of you know, Trump’s new position on Crypto has created a lot of excitement. Exhibit A3 below shows how much his view has changed over this years. This is positive for Shift4. Recall, in March 2022 they acquired The Giving Block, an integrated payment solution for non-profits and created the Crypto Innovation center to help assess related opportunities. Recently, they have integrated their offering to Give Lively, a free of charge fund raising platform that is used by ~9,000 non-profit organizations. This feels eerily like a gateway convert opportunity which adds a large list of potential E2E customers. Operating trends have also been very robust with YTD payment volumes processed by this segment up more than 2x last year’s levels.

With the market still growing, they plan to add payment capabilities starting with luxury goods merchants. This includes lodging, restaurants, special events which will be able to accept crypto or alternative currencies. The second major initiative is with Starlink/SpaceX, where customers can pay for services with crypto. The last initiative is to use crypto technology to address some ongoing fraud or merchant challenges. From my point of view, only the 1st really seems that interesting from a use case I can really envision. But, if they roll this out to all of their Skytab locations it has the potential to really differentiate them in a marketplace where BTC acceptance is very low. I can even imagine that through stable coin or crypto conversions into local currencies cash this could also drive higher net margins than the core business.

M&A

During the quarter Shift4 acquired GiveX which added a long tail of 130,000 customers and a strong gift card and loyalty offering. Churn at this business was <3% and with the top 50 customers was less than 1%. This platform had several large blue-chip customers like 7-11, Wendy’s and Recipe Unlimited. Like lots of other M&A they have done the end customer is usually utilizing a mish mash of multiple vendor solutions to achieve their overall commerce experience. Shift4 will simplify and add on to what these customers were already getting.

GiveX should be processing >10b Gross Payment across the business today. However, if I understand reported figures correctly, this GPV figure only includes the gift card payments and loyalty rewards handled by GiveX (~2.6% of all payment flows) but not all other payment flows (~97.4% uncaptured). If FOUR increases penetration of their E2E solution for these customers by ~5%, they expect a 5% uplift on gross revenues less network fees – that’s pretty big. This is like another gateway they have just acquired which sources future low-cost customer additions. It also adds specialist talent in the gift card and loyalty space and a solution that can be cross sold to other customers around the world.

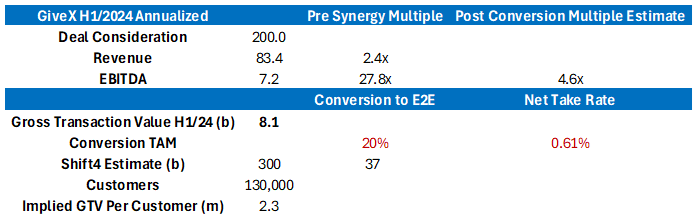

However, it seems the multiple paid is on the higher end annualizing their H1/2024 results at 2.4x sales or 27.8x EV/EBITDA. However, revenue growth seems very possible to accelerate as they convert these customers to the E2E payment solution and as cross selling efforts pay off. And. costs should drop as duplicate functions are removed or redeployed elsewhere. As shown in Exhibit A4, If they can convert ~25% of the GTV at a 60 bps take rate, this implies an incremental 37m in EBITDA. If you then add this back to the annualized EBITDA figure I had earlier, the EV/EBITDA multiple falls to 4.6x, pretty in-line with what they’ve paid for businesses in the past. While I’m not certain I can underwrite this as a base case yet, I’m guessing management is thinking about this in a somewhat similar fashion.

As always, Shift4 took a good question from X – it’s a long response but I think it’s worth reading through.

“as someone who's followed Shift4 and its creative acquisition strategy over the past few years, I was curious about the following. One, why do you believe that another firm hasn't replicated this strategy? And two, how long do you believe you can continue to pursue this strategy?”

So John, thanks. A lot of companies are reasonably active at M&A. I mean, across all sectors. I think within payment specifically, Adyen is probably the only example of a scaled payments company that has not done an acquisition. i mean, even Stripe has laid square, they've all done deals. So I would say when an industry is in transition and there's opportunity, deploying capital intelligently to take advantage of it is a pretty obvious strategy. In fact, last quarter I gave examples of like Palo Alto Networks, Apple, Amazon, all of which have taken advantage of different transitions within their respective industries.

So look, the issues are, are you doing a deal to take advantage of an opportunity or are you doing deals to fix problems? And I think many examples of late from people are trying to fix problems versus actually having a pretty solid strategy and then using capital intelligently to pull it forward.

So, I think where people make mistakes, they don't have good conviction around their synergies, they become afraid to burn the ships and focus on the future, and that's scary for some. But failing to see it through is when all those worst fears are realized, lots of tech debt, then your synergies start coming up short. You don't actually start delivering on your margin goals or free cash flow, I think that's where people make mistakes.

We're good at it because we've been doing it for 10 years, since we started our own organic integrated payment strategy back to Harbortouch. We saw the success from it and then moved to pull forward the opportunity by believing it was really our best use of capital, and we did this using our capital, not others. And then we've since learned how to do it even better.

Now the question of can this keep going on? Look, it's very early days of software post payment. So if you think we're going to run out of good ideas taking advantage of this convergence, then you have to believe that Adyen and Stripe will as well, since they are essentially chasing the same opportunity of software post payments coming together.

So, we think that there is no shortage of opportunities ahead, this has been a particularly busy year in 2024, but it was also because there was a lot of opportunity, I mean we didn't do much in 2021 when valuation expectations were in a different zip code. So we like our pipeline, I wouldn't worry about us coming up short on things that could move the needle.

Closing

Generally, I was happy with the feedback on my initial report. My initial write-up had generally a very positive view on their M&A capabilities but there is at least one exception that people brought to my attention where the investment hasn’t as obviously worked out. That was 3D Cart, an eCommerce platform which more directly competed with the Shopify’s of the world. At acquisition they renamed this business to Shift4Shop and the strategy they used was to eliminate fees as an attempt to onboard clients. However, after meaningful customer growth about 12 months after to ~70k (vs 14k at acquisition). Jared touched on how this area wasn’t a great area to invest in and how they had subsequently reduced the size of the team. This sort of ties back to how Jared talks about strengths in card present environment and this acquisition was a bit of a step away from what I believe the company’s competitive advantages and management circle of competence.

I certainly won’t be posting quarterly about all prior write ups, but I may increasingly do a follow up on a prior post to better demonstrate how some of my thinking has evolved on a particular name. With the stock at 12.8x 2025 EV/EBITDA and a long runway to reinvestment/growth I can’t help but think that Shift4 will generate very attractive returns in the years to come.