Introduction to Shift4 (FOUR)

Who doesn’t love going to a great restaurant. Great food, friendly wait staff and bartenders, good music and ambience. But, at the end of the meal the restaurant needs to be paid, and, if you’re like me, the end of an experience really matters. That means having a seamless transaction before you leave. Shift4 exists to create that dynamic in the most complex and demanding payment situations.

Paying for a meal with a credit card at your favorite restaurant might not feel so novel today, but in the 1990s only larger stores and restaurant chains were widely accepting credit cards, while smaller businesses were left behind. At the time, adding payment acceptance capabilities was a tedious, complex, and expensive processes; it involved hundreds of pages of paperwork and high upfront costs to obtain the hardware and terminals. Jared Isaacman entered the industry in 1999 and saw an opportunity to stream line this and help all merchants add electronic payment acceptance. He didn’t wait long after dropping out of high school to create the United Bank Card Company (UBC), and with their simple onboarding process, as well as free terminals and hardware, UBC’s customer base grew at a rapid pace. UBC Merchants, in return, would pay for software and payment processing through the company. After multiple years of attractive growth and returns, growth decelerated as the benefits from this superior conversion approach and broader penetrations gains approached their natural limits.

Jared then pivoted and focused on adding more technology to the platform. After rebranding as HarborTouch Jared expanded into related markets including hardware, software, and payments. The new strategy led to another decade of profitable growth, and the creation of a more formalized M&A strategy. Then, to accelerate this transition the company received its first outside investment in March 2014 from Prospect Capital Corp. Acquisitions continued to ramp up during the following two years, with HarborTouch reaching ~$10 billion in annual payments volume by the end of 2016.

In the following years, the company continued their acquisition streak, adding Point of Sale Systems (POS) such as Restaurant Manager, POSitouch, and Future POS; CurvePay (sales organization serving the Taxi/Transportation market); and finally, Shift4 Corp, the world’s largest independent payment gateway at the time. With this latest acquisition in January 2018, the company changed their name to Shift4 Payments.

Shift4 Payments was a homerun. The company processed more than $60 billion in payments. Shift4 was the industry leader in PCI-validated point-to-point encryption (P2PE) and had 100% gateway uptime since 2008 due to its redundant and diversified datacenter footprint. After the deal, the combined entity was processing more than $100 billion in payments, and the addition of PCI secure payment processing capabilities made the company stand out in a time when cybersecurity incidents continued to ramp up and the risks of technical debt were increasing within the industry.

By June 2020, Shift4 Payments completed an IPO on the NYSE under the ticker symbol FOUR at $23 per share. Since then, M&A has continued to be a core strategic pillar for the company. Notable deals over the past few years include: VenueNext, a payment solution for stadiums, arenas, amusement parks, and universities; Finaro, a European cross-border ecommerce payments provider; Giving Block, a cryptocurrency fundraising platform; FOCUS POS, a restaurant point-of-sale system; SpotOn’s Appetize which was well known for expertise in the sports and entertainment industries; and Vectron and Revel in 2024, which added many clients in Europe and significant under-monetized payments revenue potential. Lastly in August 2024, they acquired Givex Corp, a global provider of gift cards, loyalty programs and POS solutions.

Value Proposition

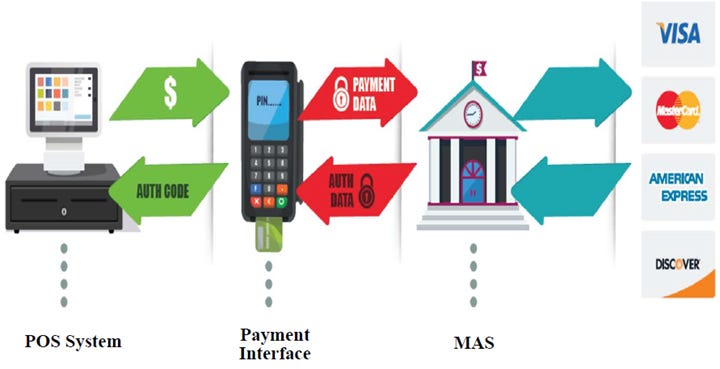

To complete a credit or debit transaction there are about four major components required: A POS System, a Payment Interface, Merchant Acquirer and Payment Network. Exhibit AA illustrates this general process and key components. Shift4’s positioning is unique because it acquired capabilities in the first three components and has >500 integrations that allow them to work with a wide range of systems. Shift4 does not operate a payment network but instead partners companies like Visa, MasterCard, American Express and Discover.

Shift4’s value proposition is that they offer merchants an integrated payment solution that is higher quality, more reliable, and has lower total costs than competing solutions.

Most merchants execute with a piece meal approach to having a full payment solution. A terminal from Joe hardware, payments processing through Bob Payments, integrations offered by Larry Information Technology Corp, and delivery capabilities from John’s application corp. This can make sense given the path dependency: as a merchant you might not need certain capabilities today. Exhibit AB below illustrates how the payment flow would look like if assembled through multiple solution providers.

This piece meal approach is still relatively prevalent in many places and is significantly less reliable than a single integrated solution. For example, most employees working at a restaurant or hotel are far from experts on any of these individual components, and a failure may be more difficult to be rectified or even identify – perhaps the terminal isn’t sending the payment processor the information or perhaps the issue is the payment gateway. Hard to identify problems are hard to solve quickly.

Shift4 positions itself counter to this situation, providing a one-stop solution (Exhibit AC illustrates their simplified payment flow relative to Exhibit AB). Instead of having individual partners for pieces of the payment problem, they do it all. FOUR believes that this bundled solution creates a superior experience for merchants through improved convenience, system efficiency, and reliability; one throat to choke has its benefits. Exhibit AC from reformingretail.com shows the contrast between a piecemeal solution and Shift4’s Skytab POS System which has equivalent or more capabilities, illustrating the improved quality and usability.

This dynamic is even more extreme if the payments solution for a customer is across multiple locations like on a resort or hotel. For example, there might be reservation systems for the restaurants, a separate system for booking excursions, and for the gift shop. Guests don’t want to see or understand the complexity of how these systems need to interact and reconcile – they just want a single itemized bill with clear line items on what they are being charged for. This is where the company’s software integration capabilities really help and has results in Shift4 winning at a rapid clip in the hospitality market. About 8 years ago they had zero customers in this vertical and now they regularly talk about having >40% of all hotels in the USA using at least one of their solutions. Similar dynamics exist in both stadiums, theme parks and special event venues.

The company charges their merchants much lower upfront hardware/software costs, as well as lower monthly fees than their most direct competitor, Toast (Exhibit AD). Over five years, this results in customers spending 72% less with Shift4 than their direct competitor: $18,000 versus the $65,000 estimate for the Toast alternative. This demonstrates the value proposition for its customers and why Shift4 has been able to drive market share gains. Shift4 is able to charge less than peers as their strategy focuses on locking into customers into their integrated payment solution instead of just selling either hardware, software or payments processing. Through bundling they can capture higher returns. Shift4 can act as both an acquirer and a gateway for customers they can act more competitively on pricing for each component.

Business Model

There are three major pillars to the company’s business model: technology solutions (hardware, software & integrations), a payments platform (Gateway and E2E payments), and partner-centric distribution (VARs and ISOs as partners). Shift4 generates revenues through two main categories: End-to-End (E2E) and Gateway. E2E customers utilize the integrated platform for payment acceptance, devices, POS software, and business intelligence tools.

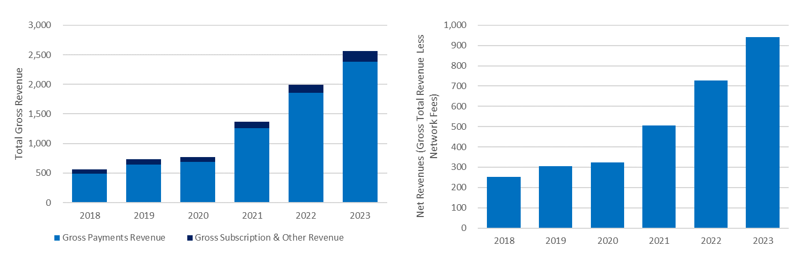

E2E customers generate fees based on the number of transactions processed. Also, a percentage of processed volumes. And monthly fees for equipment, hardware, data, or analytics. Gateway-only customers are limited to paying per-transaction fees. Fees are low, about 3-5 cents. These customers benefit from being able to route payments to the preferred third-party payment processor. In contrast, a full E2E customer would pay 30-100 bps of the payment volumes. As of last quarter, Shift4 customers paid a blended rate of 62 bps. They would also pay 4-5 cents per transaction and monthly fees for the point-of-sale system, software, and hardware. Both potential options pass on interchange fees and network fees to customers. In Exhibit AE below, we display gross revenues by category and net revenues from 2018 to 2023, which grew at a ~30% CAGR.

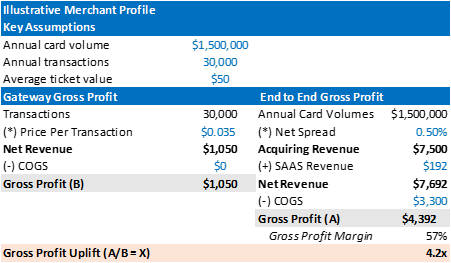

Exhibit AF below provides an illustration of what an individual restaurant’s economics look if they convert from the gateway only option. As an incentive to convert, they have often waived gateway fees, upgraded hardware in return for securing the merchant acquiring payment flows. So, there are some reasonable incentives for merchants to complete a conversion If the discount rate is similar enough. However, they do have hurdles to overcome – most merchants aren’t really prioritizing optimizing payment processes and instead tend to prioritize managing and optimizing restaurant operations. Merchants can also sometimes loyal to their banking partners who offer merchant acquiring as part of a bundled financial services solution. From an industry perspective, it appears that a lot more customers are shifting to an E2E solution and away from Aloha/Micros which have historically been the legacy solution in place.

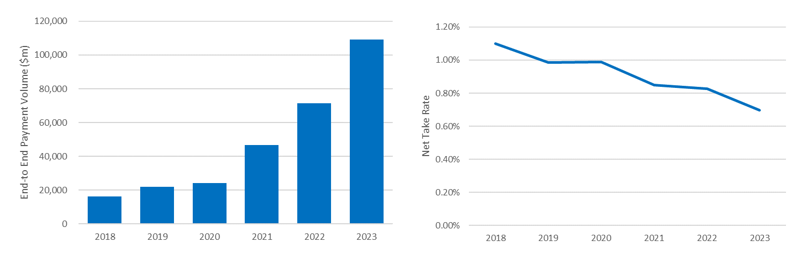

E2E payment volumes have grown at a T5Y CAGR of 47% to $107 billion, which has been the largest driver in revenue growth. Offsetting this has been gradual pressure on the net take rate which declined from 88bps in 2018 to 65 bps in 2023. FOUR’s ability to scale into new verticals, such as hotels and stadiums, has allowed growth to persist, but has come at the expense of the take rate. I think Shift4’s growth will continue as they have expanded into non-profit, retail, gaming, and e-commerce markets. Exhibit AG below shows the trend in E2E payment volumes and the company’s net take rate on these volumes.

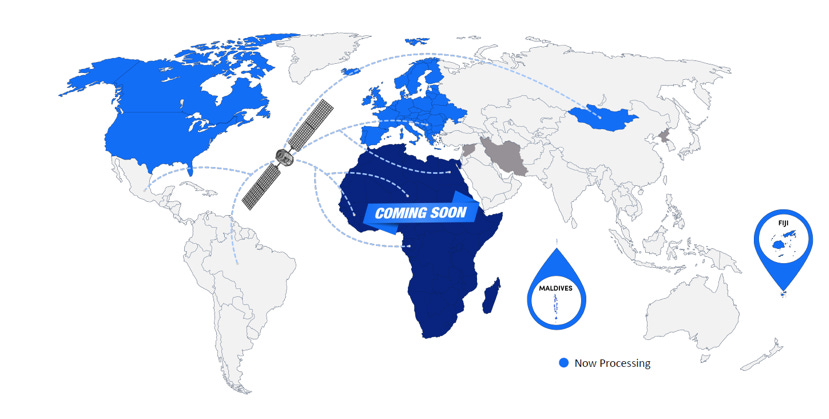

FOUR believes they can still convert over time under-monetized E2E volumes worth >$500 billion. While I’m not sure all of these will necessarily convert, the TAM is estimated at >$3.5T so the runway seems sufficiently large. I’m relatively comfortable that they will continue to growth as they expand into new regions around the world. Recall, the Finaro acquisition will enable them to offer the same value proposition to European customers, where integrated payments solution is far underpenetrated compared to US markets. The SpaceX Starlink-Shift4 partnership also seems very valuable in supporting their going global strategy. At the time of announcement, they estimated $100b in subscription payment revenue potential and this also opens a larger pool of global ecommerce opportunities. Exhibit AH from a recent investor letter from the Shift4 highlights the current areas where they process payments, but this also shows the ample white space they have the potential to expand into over the long run.

The SkyTab POS distribution strategy also appears superior to competitors who use a blanket approach across regions. Shift4 took a different approach, separating the key markets into areas which had low-density and high-density customer bases. Exhibit AJ below shows Shift4’s position as of Q3/2022. For the higher density markets, they consolidated the distribution partners eliminating the residual payments that would have been paid out to them. This approach allowed them to lower their overall distribution costs but still maintain capabilities in both lower/higher density markets. This should add up to better economics vs peers over time.

Economics of the Business

Shift4 strategy of converting gateway-only customers to full E2E customers drives much better economics. Due to the nature of the integrated nature of their payments capabilities, they can capture a higher share of the economics of the Merchant Discount Rate (MDR). Some experts think this allows them to capture 20-30 bps more of the Merchant Discount Rate (MDR) which tends to range from 1-3%. The company’s consolidation strategy has also allowed it to grow the potential E2E conversion TAM at an attractive rate and grow its customer base in a capital efficient manner. They’ve done this despite providing better on-site customer service and support which customers in their core verticals highly value.

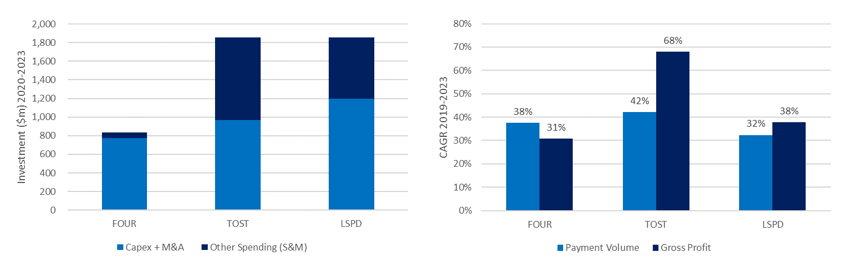

But, first let’s look at the total investment FOUR and a few peers have made over the past 4 years (2019-2023). Exhibit AK shows FOUR invested $836m, TOST invested $1,858m and LSPD invested $1,858m. So, peers invested about 2x the level FOUR did, with the vast majority being much higher spending on sales and marketing. From what I understand this means heavily advertising online on Google/Facebook and offline with sales representatives aggressively knocking on doors. TOST for example completed ~48% of it spend on S&M while LSPD did 35%. FOUR was the outlier spending only ~8% of its investment here.

On the right-hand graph above, we can see the relative growth rates in payment volumes and gross profits. On this basis, FOUR sort of looks mixed – 2nd ranked volume growth, and lowest gross profit growth. However, to evaluate them we have to look at the total investment relative to the incremental Gross Profits they were able to capture. On this basis, as shown in Exhibit AL below, FOUR stands out as by far the most efficient with a 61% GP conversion rate on investment vs peers at 17-42%. Shift4 uses a strategy unlike the others and is generating better incremental economics – what’s not to like.

The next question, would be well that nice and all but will this persist? I think it’s very likely to persist, because they’ve trained themselves culturally as an organization to be efficient with cash and manage expenses tightly. This is due to their history, where they didn’t take any outside capital for something like the first 15 years of the company’s life. Other Fintech peers had quite the contrary approach, taking multiple rounds of venture capital investment to allow cash burn and scaling up to sustain for a few more years. Exhibit AM is a tweet from Jared emphasizing this dynamic.

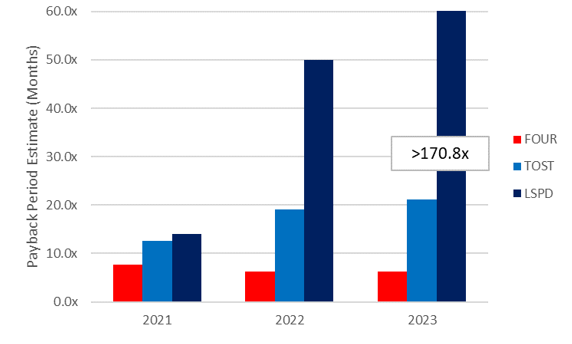

Taking things a bit further, if we look at the CAC and estimated paybacks for this group. FOUR still looks the best as shown on Exhibit AN. To calculate paybacks, we look at net hardware and professional losses plus S&M spending. Then we look at the incremental GP based on the take rate of a particular year to get a payback estimate. Here we can see, FOUR ranks by far the best with consistent payback consistently less than 8 months. This was while TOST and LSPD delivered deteriorating metrics – which seems to suggest their strategy/execution isn’t necessarily going as planned. FOUR was able to deliver these results while its net take rate fell from 82 bps in 2020 to 65 bps in 2023. Peers on the other hand had modestly increasing take rates which makes the result that much more impressive.

M&A Machine

Shift4’s strategy is ultimately to deliver a superior commerce experience – they do this through a build, buy and partner approach. Focusing on the Buy piece, the company’s acquisitions can generally be classified in two major categories. Deals need to add additional technology capabilities that can expand what they can do or that benefit the current customer base. The second is deals that expand the number of customers – usually this means POS Systems which have a large base of payments that could be converted to the E2E solution.

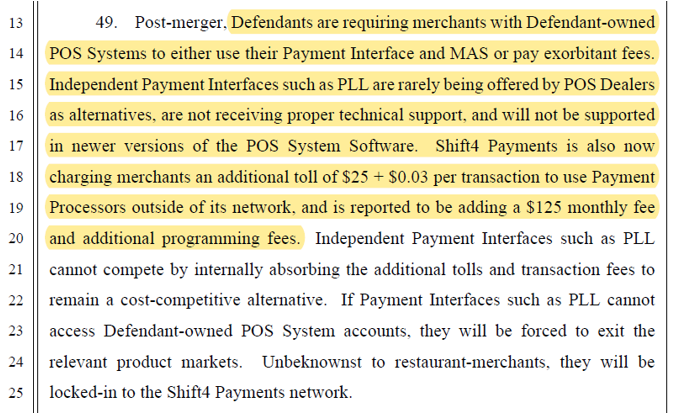

Shift4 has prioritized the roll up of a number of POS systems. These systems collectively enable the managers of restaurants to assess performance, productivity and adjacent functions like inventory controls and back-office reports. They are effectively the restaurants “brain” allowing employees to “place orders and display in a kitchen, manage table seating and reservations, combine orders placed with bartenders and waitstaff into a single bill, add mandatory gratuity, track and control inventory, manage deliveries, record employee entry and exit times, measure employee productivity, assist with financial management, and sometimes, track customer loyalty programs.” Each of these POS System acquisitions adds 1,000s of potential E2E customers. Post-acquisition, they require these customers to either use their payment interfaces (Shift4/Dollars on the net/MerchantLink) and their merchant acquiring capabilities or often face a range of higher fees to maintain. Prior lawsuits outlined high expectations for this strategy to drive market share in the payment interface market for restaurants from <10% in January 2018 to >40%. Exhibit AO, shows an excerpt from the Payment Logistics Limited case from April 2018. From an industry perspective, as volumes roll away from the independent payment interfaces (towards Shift4), this creates profitability headwinds for competitors in the PI market. Over time this results in a consolidated market in both POS systems but also Payment Interface market, creating a future opportunity for Shift4 to execute on pricing increases.

Shift4 also takes a very radical approach with its POS system acquisitions. Jared calls it blowing up the prior economic model and replacing it with a payment-oriented model. Their ability to do this allows them to capture both revenue and cost synergies. As shown below in Exhibit AP, for FocusPOS, under the prior owner the going to market generating much of its revenue from one-time sales. As FOUR integrated this deal, they immediately deprioritized this one-time sales model which led to revenue falling ~54% post acquisition. But then as they shifted the model towards a bundled payments and SaaS revenue model revenues grew to 5x the post acquisition low and >3x the level achieved prior as customers converted to the E2E solution. Through this transition the revenue quality has also drastically improved with >95% the revenue today largely recurring in nature. Costs for these types of deals are usually quick to fall too, as acquired entities tend have their own hardware, software and integration teams which can be reduced in size/scope. Far as I can tell, they’ve replicated this playbook many times and going forward will execute this on the recently announced Vectron and Revel deals. Some nuances will change depending on the footprint in a specific region and localization dynamics, but I don’t think they are material in terms of the overall approach to elaborate on.

One example of a particularly successful deal was of VenueNext in 2021 for $72m. Similar to the prior mentioned approach Shift4 executed the same playbook but in a new vertical as VenueNext had relationships and expertise in stadiums, arenas, amusement parks and corporate campuses. On its own I think the VenueNext solution was quite attractive. The value-proposition for attendees to these venues is that you could have your tickets, parking payments and food ordering centralized in one place. Similar to the POS System deal category, instead of keeping the legacy model for monetization they began to transition more of the customer base to a bundled payments and SaaS revenue model. In my opinion, this deal looks a way better than the typical POS deal as penetration of the solution into stadiums around the world is still low and that there are two major areas where upside could surprise. The first is that ticketing sales are still in many cases handled by companies like Ticketmaster. However, Shift4 has increasingly been able to convert them over the subsequent ~2 years after winning the initial F&B contract. Experts have also touched on how this can be huge win for the Arena owner or operator as revenue capture on Ticketing increases from ~95% with Ticketmaster to ~98% with Shift4 and SeatGeek Partnership. For a venue that has a full calendar of concerts, and other special events I think this translates into millions of dollars of savings. Remember for most operators, having fewer vendors leads to less complexity and allows them to focus on core aspects of their business. Given the average ticket price is something like 4-6x, what a customer might spend on concessions, merchandise and parking, the potential step up in revenues as this is captured looks very significant. Second, sports betting continues to be legalized in many markets globally, and those wagers whatever the size can increasingly be completed through the same applications. But, even if it isn’t in the same applications, Shift4 can capture revenue from payments processing for BetMGM which has ~13% GGR share and ~22% share in iGaming. Post acquisition after the same blow up of the prior economic model, VenueNext is generating 7x the revenue and it is much higher quality with ~90% recurring in nature. Each quarter, we continue to hear of more stadiums that are selecting Shift4, with an increasingly skew of wins in Europe. If I had to guess, this deal was probably amongst the top 5 value creating deals done in its history.

To round it out, I think their M&A strategy has allowed them to expand the customer list efficiently and expand into new verticals building on prior capabilities. An excerpted below from FOUR’s Q2/2024 Letter summarizes the playbook.

1. We don’t win banker auctions; we find overlooked and attractively priced assets through our own proprietary process.

2. We confidently underwrite revenue synergies by cross selling or bundling payments.

3. We blow-up the existing revenue model (one-time software, hardware sales, etc.), often taking steps backwards, to run far forward leading with an integrated payments offering.

4. We aggressively delete parts. Parts can be legacy products, internal systems and other costly expenses that don’t fit within our plan.

5. We align the talent and distribution with our strategy, enhance the value proposition with payments and win without delay.

Competitive Advantage

In my opinion, Shift4 benefits from multiple factors including Switching Costs, Distribution, Economies of Scale and Scope and Network Effects.

Customers face high switching costs for systems once installed because the employees need to be retrained and build experience working with them. Outside of the initial fixed charge that competitors would charge, the more meaningful cost for employees is the retraining and integrations that need to be completed when a new system is put in place. This ties into the habits of employees too. If they had a certain process to complete a tip-out at the end of a night or compiling a customer’s various charges across multiple sales points, then any system changes can result in lower dollar throughput at a location until they can get back to a certain level of efficiency.

If we revert to the company’s history, they also benefit from distribution advantages. This goes back to the company’s gateway capabilities which are a middleware like business in the payments industry. They can source customers from this area or through third party sales organizations. But, despite these advantages they don’t use a blanket distribution approach which highlights the thoughtfulness of the strategy. Back in Q2/2022, Shift4 acquired a number of independent sales organizations who used to sell their payments solutions but also previously sold competitor solutions. By acquiring these partners, they cut off a large variable compensation which was near 40% of variable revenues that they would typically pay. Management estimated an <1 year payback period on these investments. They only did this in select regions where they had confidence that these recently converted employees could be redeployed to continue selling to customers. Exhibit AQ below outlines the impact on Skytab unit economics because of this change.

From an efficiency advantage, the consolidation activity they have driven for POS systems has allowed them to consolidate multiple individual R&D, integrations and relationship management activity into fewer areas. Now Shift4’s POS system Skytab, appears to have just about every feature that could be required from customers. The second piece that drives efficiencies is the >500 integrations they have with other software like Quickbooks, MS Dynamics, SAP etc. Once these integrations are implemented for one customer into Skytab, the second, third and fourth are much more seamless. This piece might be underappreciated, as >500 integrations also mean regular updates from each of these software vendors which might need its own modifications to work effectively. As this activity can be centralized, it should drive a lower cost per transaction for the average customer.

Competitive Landscape

Shift4’s origins are in the Full-Service restaurant (FSR) market and over time it has expanded into adjacent card present markets like hotels, stadiums and theme parks. If we look at split between the segments using the Global Foodservice market as the TAM, FSR markets represent about 46% followed by Quick Service restaurants at 33%, Cafes at 15% and Street food at 6%. Exhibit AR separates the market size by classification over time, for 2022 and by country.

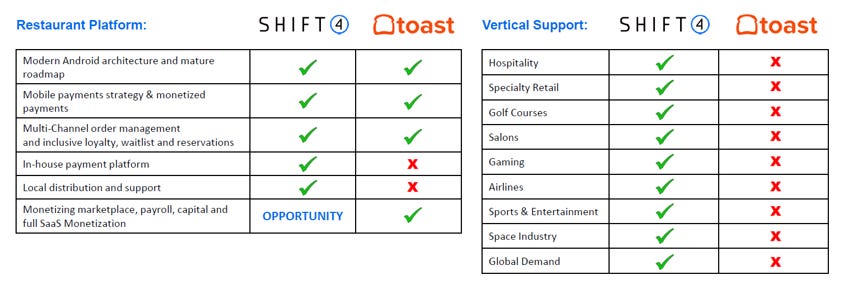

I think each of these sub segments operate with varying levels of customer risk, payment acceptance problems, and complexity in needs. At a smaller scale, I think lots of the restaurants with less than 20 locations (Street Food + Cafes) can be satisfied with a solution from Square or Clover, where payment acceptance problem is solved, contracts are limited in nature and implementation is relatively easy. In the QSR market, Par Technology, Xenial and Qu seems to be one the go-to companies in the space, and competition appears quite high even from the legacy acquirers who tend to compete on price. Here I think loyalty programs, software integrations and operational complexity move quite a bit higher. Lastly, in the FSR market it is a duopoly between Toast and Shift4. And while they both compete in restaurants – Exhibit AS below, outlines how Shift4 has exposure to many other verticals where they are also winning.

Toast’s growth strategy in the FSR market is very aggressive. It involves the deployment of many employees to generate relationships and increase penetration of its solution in the FSR market. Shift4 takes a different approach having only dedicated staff in select regions but otherwise leaning on independent sales organizations (ISOs) to go to market. Prior organic growth campaigns having included a $2k referral bonus to anyone who successfully refers their local restaurant or bar - which is cheaper than the average CAC to obtain a customer in the industry. Jared was asked in a recent call what’s the biggest reason why a customer might pick Toast over them? It came down to who was able to reach the customer first. This suggests that either POS isn’t materially better or worse, and having a system with a similar enough capability is just table stakes. Even from the restaurant customer perspective that makes sense, food isn’t going to taste any better or worse through payment partner than another.

But, that’s not the only thing that might matter. Restaurants are going to have issues with payments and TOST appears to have skewed its employee base towards sales rather than service. If a TOST terminal is down or receipt printer isn’t working, a merchant needs to dig through the “knowledge base” aka support forums. If that doesn’t solve the issue a customer service agent accessible on 1-800 number attempts to troubleshoot. FOUR on the other hand will have representative come on-site to service or replace equipment on site when required. So, at the margin, it seems like the customer experience is at least somewhat better, but I couldn’t get a great sense if its 10% or 100% better.

Once either of these companies secure a relationship, relative churn matters too but neither provide any clear data on what that could look like. However, we can look back at prior company action with how they treat their restaurant partners to get a qualitative sense for how they think and manage that relationship. Back in 2023, Toast was caught up in a flurry of negative headlines for charging online ordering fees to its customer base. For all orders above $10 or more they began to charge an online ordering fee of 99 cents directly to customers. Exhibit AT below, shows an example of how this fee is communicated to the end customers. But, worst of all the fee would go directly to TOST. These fees were tagged onto online orders, but also those through aggregators like DoorDash, and Ubereats. This led to widespread discontent from both restaurant customers and restaurant owners, with the former seeing higher prices and the latter not getting any capture of this fee that was tacked onto customer bills. Media reports indicated that the fee was added without the consent of the restaurant owner, but I’m not sure that’s necessarily the case, it was probably just fine print in the documents they signed which they never read.

Another anecdote to consider, is that back in August 2021, TSYS which runs the front end of some of Shift4’s payment volumes suffered a multiple hour outage. FOUR immediately communicated to its partners that while they were not responsible for the outage but that they would compensate the merchants for this issue. Exhibit AU shows the notification from FOUR. This sounds and feels like swift action in the event of bad outcome for clients. While anecdata, it seems like at least at the margin they are a better company to partner with in the space.

Management & Governance

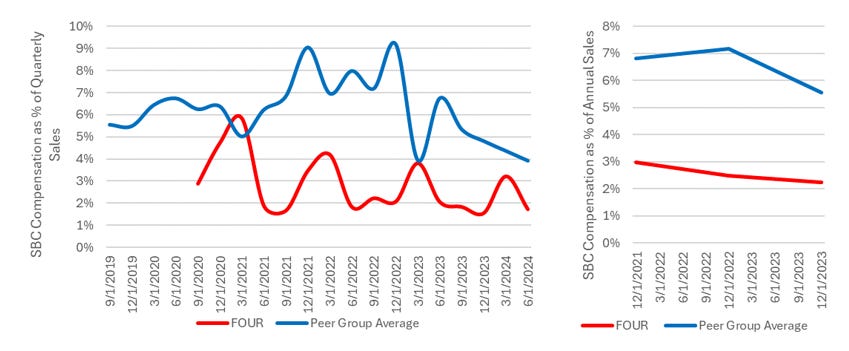

As Founder, CEO and Chairman of the Board to invest in the business you need to have at least a modestly positive view on Jared. He controls ~81% of the shareholder votes through Class B and Class C shares but has instead an approximately ~30% economic stake in the business. Since IPO it appears he’s been a relatively consistent buyer of FOUR shares, and a few of his purchases back in 2022/2023 look remarkably timed in retrospect. There have been two disposals reported but my understanding was that these were tied to donations at St. Jude Hospital, which might have helped him win them as a client. Also in a relatively unusual move, he personally funds half of the employee share ownership program from his personal stake. With full control, remaining in the leadership position and outright funding employee compensation with his own equity – it seems like from every perspective he’s treating this his own business. This is also clearly reflected in the cost structure, given the relatively limited use of SBC and his awareness that this is a real cost to equity owners. Exhibit AV shows a comparison of SBC relative to revenues on a quarterly and annual basis for Shift4 compared to a Peers for the past 5 years – this shows how differently they utilize this compensation and financing tool relative to the industry.

Jared’s business sense looks good as we look back on the past few years too. He timed his IPO relatively well, during a period of euphoria for fintech’s. And while the opportunity was open, he successfully completed two convertible debt issuances at a <1% coupon which was used to execute on M&A. Jared also took an opportunity to acquire several distribution partners back in Q3/2022 for $260m – this move selectively shifted their distribution approach to 50/50 internal and external after previously using a 100% partner model. This deal added modest fixed costs but materially reduced variable compensation to the partners. And, unlike competitors who use a blanket organic growth strategy, they only did this for regions that were more densely populated and where they had higher visibility on the growth of the business. Jared’s ability to change his mind seems special, and unlike what I’ve seen with many other CEOs. There was a quote I had saved but can’t find about how he still reviews old emails and decisions he made >10 years ago to try to learn from – that’s what I like to hear.

I’m a fan of Jared, and how he thinks about business – his twitter feed has a ton of interesting comments at times. He’s willing to address criticisms openly, and each quarter they also source questions from X (formerly twitter) which I think are amongst the best questions asked. Even when faced with criticism from anonymous X users, he openly clarifies misunderstandings and criticisms. While some might argue that might not be the best use of his time, I think we operate in an age where this is much more helpful than not. If Jared or anyone at Shift4 reads this I’d suggest they try to organize some of the Q&A they have with investors like Morningstar does on their website. Exhibit AW, below is a sample response from Jared after a X user made a public post that was clearly misunderstanding its M&A strategy.

What do I think the market is underwriting?

I like to get a base understanding of what the market is thinking for the key drivers for the business – these are the assumptions I need to use in my DCF model to get an intrinsic value estimate near the current price of ~$90/share.

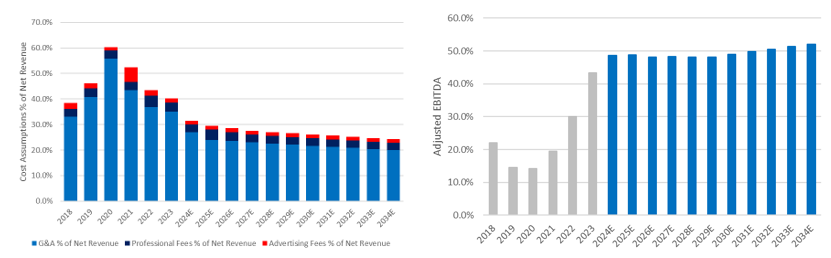

Starting with Revenue drivers, we must assume that growth decelerates meaningfully over the next 3 years an approach 2% in our terminal forecast. This implies a 12% CAGR for revenues vs the 30% CAGR they delivered from 2019 to 2023. This appears unusually punitive given they still have a meaning conversion opportunity to convert gateway customers, have global market presence now, and strategic customers who are supporting their growth in new regions. Shift4 has also successfully ramped up in new verticals where it appears the runway for growth is far from mature. This sort of implies a low capture of its 3.5T TAM outlined from its investor day in late 2022 – this feels too low given historical trends and a large customer base which still has meaningful conversion opportunities to their E2E solution. Exhibit AX outlines the implied revenue growth rates and total revenues.

Since IPO, Operating costs (excluding D&A) have scaled lower by ~20% while adjusted EBITDA margins have scaled to ~43% by 2023. Using 2024 Guidance as a base implies another >500 bps improvement in margins as benefits from operating leverage, and scaling of fixed costs help profitability. We then set G&A to decline in percentage terms by ~2% per annum but still growing in absolute dollars with costs still up roughly doubling from 2019 levels by 2029. For Advertising and Marketing expenses and professional fees expenses approach 2.8% and 1.5%, respectively in our terminal year. This implies little to no improvement on a % of net revenue basis for these two-line items. With these expectations this implies reach ~49% in 2024, then after a period of stabilization grow to 52% by 2034. Exhibit AY outlines the implied operating costs figures as % of net revenues and EBITDA margins.

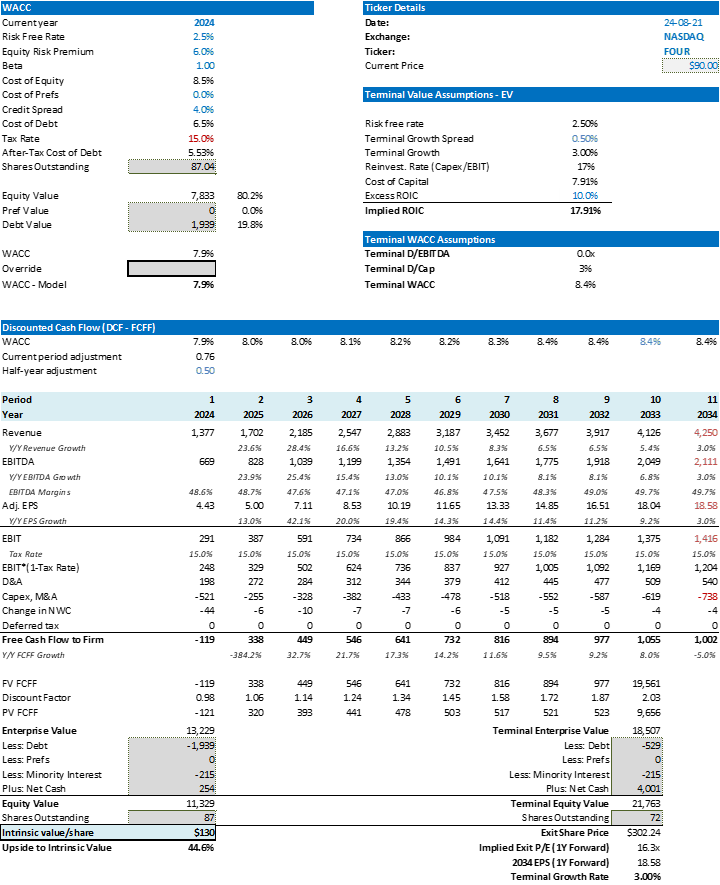

Using these assumptions, I get an EBITDA CAGR of 14% over the forecast period. For reinvestment, we assume capital expenditures at 1.5% of net revenues, intangible investments at 6.5% of revenues and investments into leased equipment at 7% for most of the forecast period. This implies total capex investment into the business at ~15% of net revenues – about where the business has operated historically. This also assumes no M&A, which is challenging to forecast the timing and magnitude of.

Even with these assumptions, my model suggests Shift4 could repurchase >$3.8b in shares over the next decade without having no absolute debt which appears very conservative given the relative stable, and recurring nature of cash generation at Shift4. In the DCF I use an 8.5% Cost of Equity, 6.5% Cost of Debt and ~18% Terminal ROIC. This implies a P/E multiple of 17x, modestly lower than the current multiple of 21x P/E as of October 2024. A snapshot of my DCF output is below in Exhibit AZ.

Personally, I’d be very surprised if this scenario played out over the next decade. Even if this occurred, as a shareholder you should be able to own the business and still generate an ~8.5% return which is far from terrible. I’d be very happy to take the over on these assumptions.

What do I feel comfortable underwriting?

In the base case I came up with a set of assumptions that I feel comfortable underwriting.

Starting with 2024 guidance as an approximate base for my expectations. Net revenues are expected at $1.37b, then expected to grow at a 16% CAGR into 2034. Driving this is E2E payment volume growth growing at an 18% CAGR, the gross take rate falling from ~2.1% to ~2% over the forecast horizon due expectations of more growth from Hospitality, and larger enterprise customers. Gateway revenues are expected to decline at 2% each year as these customers continue to convert to the E2E solution. Subscriptions expected to grow double digits until 2030 then continue to decelerate to ~7% growth in the terminal year. For network fees we expect them to modestly decline to 140 bps but about in-line with 2023 expectations for the firm - I’m uncertain they can get much more leverage on this line item but it remains possible. Exhibit BA shows my overall net revenue growth expectations, segment gross revenue expectations and take rate expectations.

Using 2024 Guidance as a base implies another >500 bps improvement in margins as benefits from operating leverage, and scaling of fixed costs help profitability. We expect G&A to fall to the low 20s by 2034, a 500-bps improvement, roughly half of what was achieved from 2020 to 2023. Advertising and Marketing expenses and professional fees fall modestly as a % of revenues approaching 3% and 1.5%, respectively in our terminal year. With these expectations this implies EBITDA margins reach ~50% in 2034, after modest decline in 2029 driven by reduced operating leverage. Exhibit BB outlines the operating costs figures as % of net revenues, Adjusted EBITDA and adjusted EBITDA margins.

To deliver on this expected EBITDA growth, I kept Shift4’s reinvestment needs roughly flat at 14-16% over the forecast period – largely matching depreciation. Incremental capital will be deployed via M&A, but I don’t underwrite any incremental acquisitions in the model.

With high teens EBITDA growth, Shift4 deleverages rapidly over the forecast horizon. I have them paying off all of their outstanding debt by 2029 then building up net cash on the balance for the terminal year. This leaves a large buffer for returns of capital to shareholders. Even with the net debt repricing at 6.5%, absolute interest costs fall over the horizon. FCF to the Firm reaches >$1b by 2033.

In the DCF model I utilize a 8.5% cost of equity, 6.5% cost of debt, 18% terminal ROIC and a 3% terminal growth rate. Using these assumptions, the implied terminal multiples are ~19x P/E and ~8.7x EV/EBITDA. Fair value in my base case is ~$130/share, which is 44% higher than the current stock price and implies an 10Y IRR of ~13%.

You can adjust my assumptions in the model below if you have different views on the key drivers. Below in Exhibit BC is a snapshot of my DCF output.

Conclusion

All said, FOUR is an exciting business and operating in a consistently growing area. Payments generally grow at a multiple of GDP and should be more insulated than many other businesses even if a recession occurs. There appears to be significant reinvestment opportunities both organically and inorganically. They have cycled past a period with higher debt, substantial M&A integration, and new geography/vertical expansions. The future looks bright. Shift4’s competitive position appears strong, but the payments space will continue to evolve and future pressures or competitive threats may come from unexpected areas. As far as I can tell this is an above average business that should be able to generate ROIC’s ahead of its cost of capital for many years to come. In my opinion, Shift4 is set to create a ton of shareholder value over the next decade under Jared’s leadership. Given the relatively attractive risk/reward, I am currently a Shift4 shareholder.

As always, if you have any questions or disagree with any of the analysis/views, please fire away in the comments below. You can also reach me on X/Twitter at @icemancapital or icemancapital@gmail.com. Thanks for your time and interest in the idea.

Great writeup. You nailed it!

Excellent writeup, thanks for sharing!